Community

✲

Impact

✲

Success

✲

Capital

✲

Influence

✲

Community

✲

Impact

✲

Success

✲

Capital

✲

Influence

✲

Overview

MASTER THE MACRO

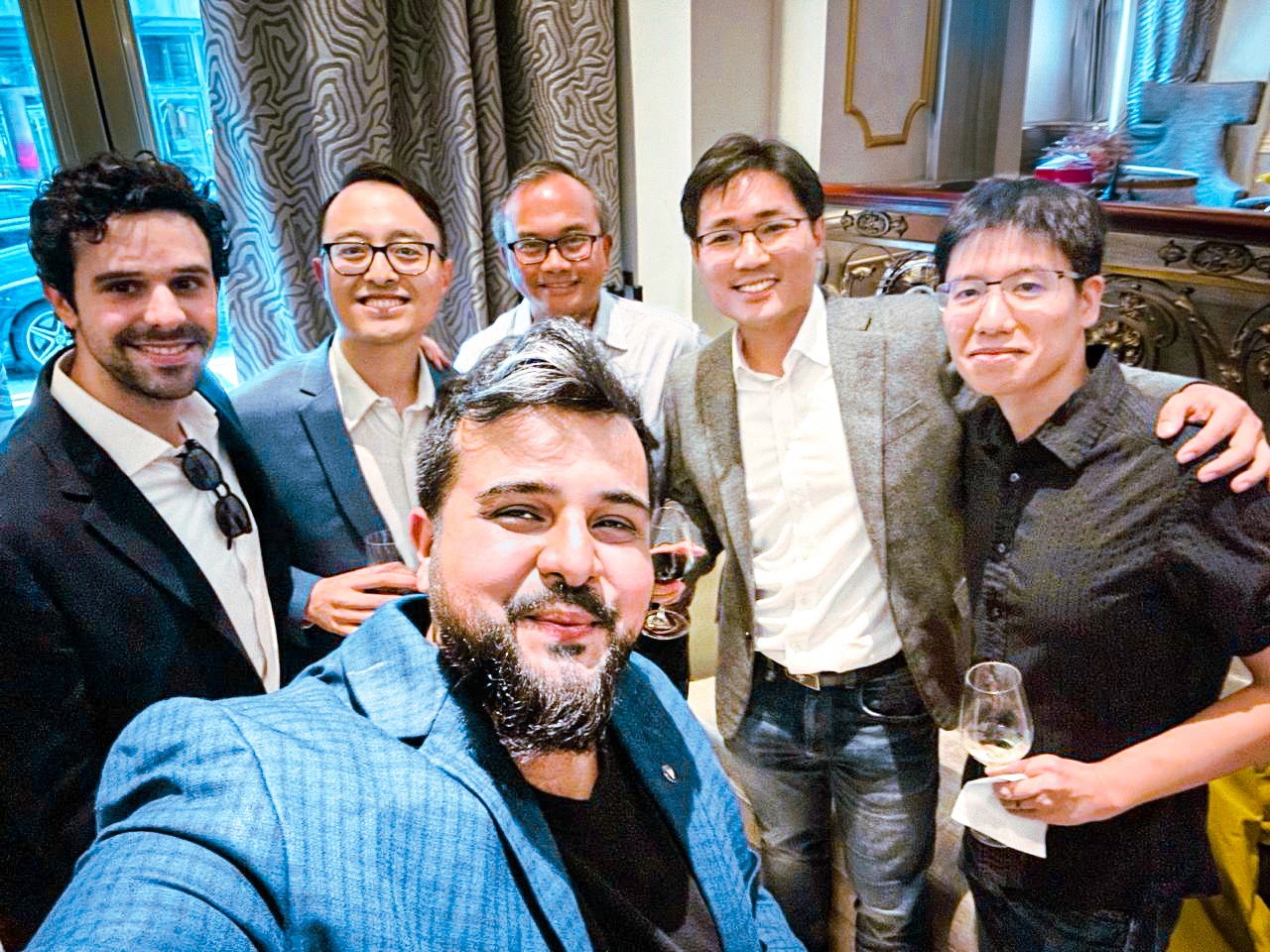

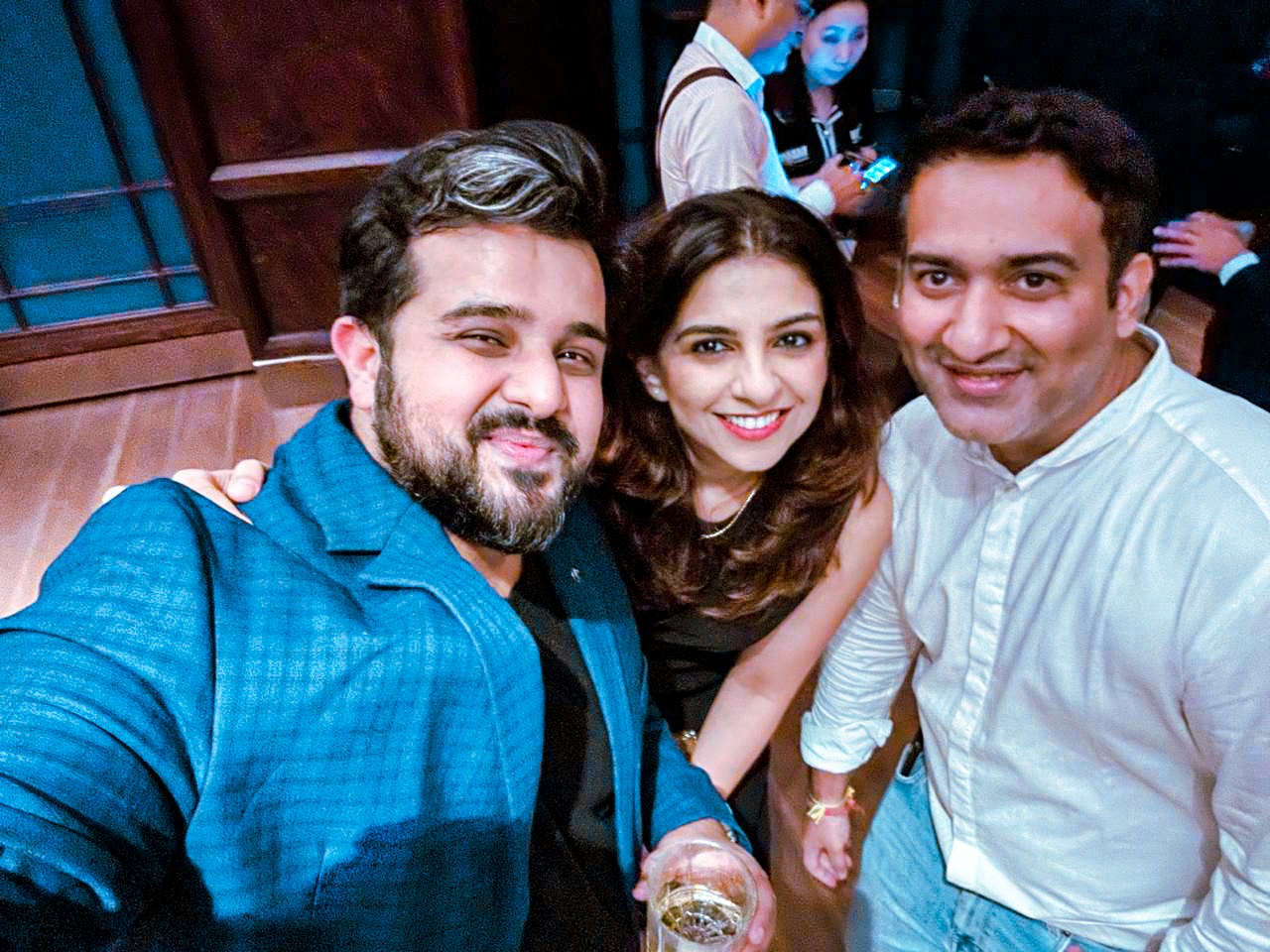

The program bridges the gap between capital legacy and modern stewardship. It also provides entry into the 256 Network, a global ecosystem of trust, discretion, and long-term alignment across sovereign wealth funds, pension funds, endowments, family offices, and private equity/venture capital firms.

In this program, stewards don't just study the market; they learn directly from the architects who have built and sustained institutions across generations.

Upto 8 Fellows

Per cohort

12 months

Duration

Overview

an international platform

The program bridges the gap between capital legacy and modern stewardship. It also provides entry into the 256 Network, a global ecosystem of trust, discretion, and long-term alignment across sovereign wealth funds, pension funds, endowments, family offices, and private equity/venture capital firms.

In this program, stewards don't just study the market; they learn directly from the architects who have built and sustained institutions across generations.

12

months

Duration

Upto 8

Fellows

Per cohort

Program Details

WHAT THIS PROGRAM ENTAILS

Stewardship Sessions

These sessions will involve the stewards and experts. The agenda includes learning sessions, speaker-led sessions, and dedicated time for building deep and authentic relationships.

256 network Mentors

Stewards will be assigned a mentor based on their capstone focus area. Mentors will help shape perspectives, challenge their perspectives, and assist in unlocking macro and micro strategies.

Capstone Access

Stewards are required to build a capstone thesis in a particular area, working with the principles of family offices and present to a private 256 audience. Upon completion, stewards will formally enter the 256 Fellows Circle, ensuring continued access to this global trust network & vision.

One Global Summit

Join us at the 256 Global Summit, which provides access to the members of 256 Network, a global ecosystem of trust, discretion, and long-term alignment across sovereign wealth funds, pension funds, endowments, family offices, and private equity/venture capital firms.

Selection Criteria

The Fellowship Program Tracks

Integrated Insight

These sessions will involve the stewards and experts. The agenda includes learning sessions, speaker-led sessions, and dedicated time for building deep and authentic relationships.

Invisible Leverage

Collaborate with leading founders and business decision-makers whose judgments move

capital, influence policy, and define new markets.

Inter-generational Capital

Moving beyond "quarterly returns" to 50-year horizons and multi-generational wealth preservation.

Institutional Continuity

These sessions will involve the stewards and experts. The agenda includes learning sessions, speaker-led sessions, and dedicated time for building deep and authentic relationships.

Structure

THe Journey

A one-year journey from insight to influence designed to shape tomorrow’s

capital leaders

1-2 Months: Alignment & The Boardroom

Stewards will engage in Boardroom Dialogues—intimate, closed-door deep dives into governance, family dynamics, and capital cycles with global leaders.

3-6 Months: The Capstone Construction

Partner with both 0-1 disruptors and scaled-up operators to master the craft of building. Navigate the chaos of early-stage execution and the systems of high-growth scaling—gaining the hands-on grit required to build new ventures from scratch.

7-8 Months: Validation & Execution

Stress-test stewards strategy against the wisdom of experienced allocators. Validate thesis, governance structure, or platform before real-world deployment.

9-12 Months: Integration

Present your Capstone to a private 256 Network audience. Upon completion, you formally enter the 256 Fellows Circle, ensuring continued access to this global trust network continues as they execute their vision.

THe Global Rotation

A one-year journey from insight to influence designed to shape tomorrow’s

capital leaders

Month 1: Europe / UK (Governance)

Focus: The Constitution, Trust Structures, and Family Unity.

Host: Historic Multi-Family Offices.

Month 3: USA (Capital)

Focus: Deal Flow, Venture, and Allocation.

Host: Wall Street Allocators & VC Funds.

Month 5: GCC (Sovereignty)

Focus: Geopolitics, Energy Transition, and Post-Oil Diversification.

Host: Sovereign Wealth Advisors & Mega-Project Developers.

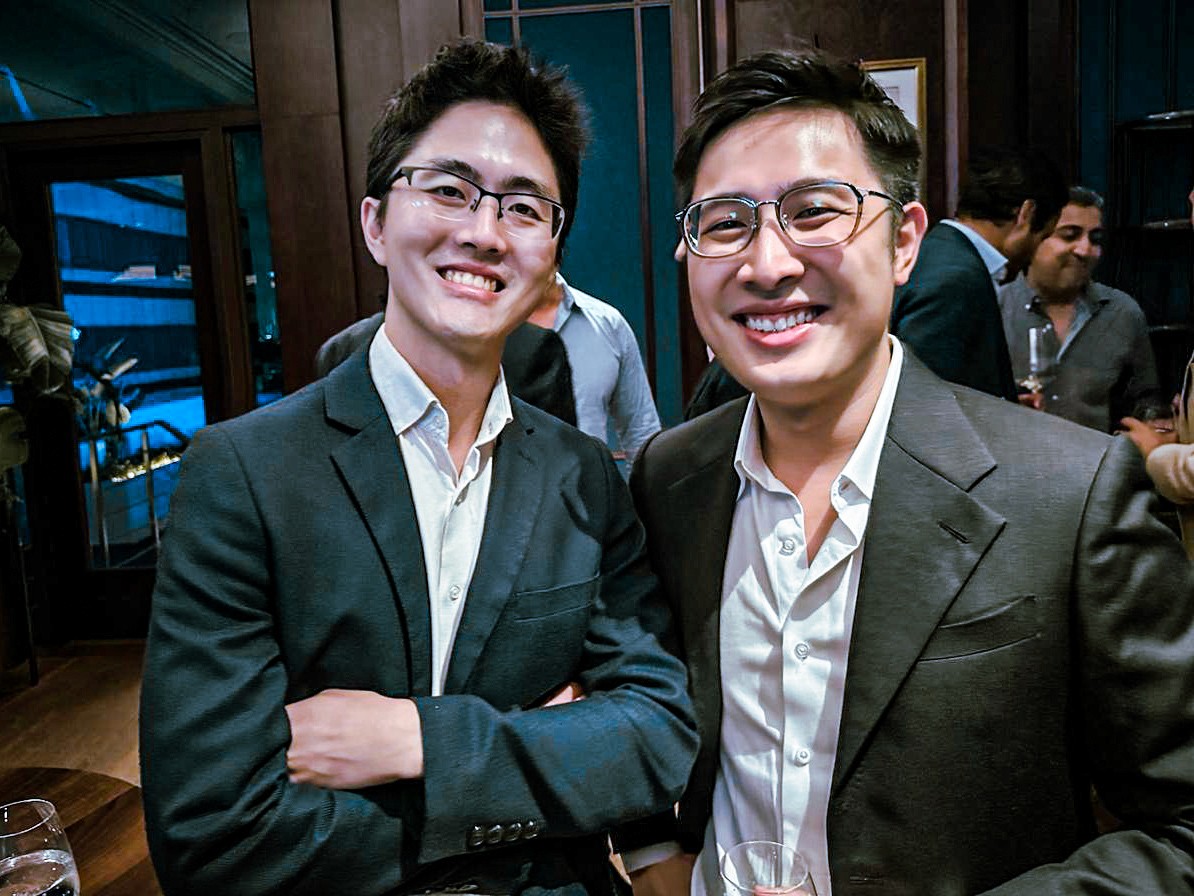

Month 7: Asia (The Future)

Focus: Succession, Tech Innovation, and Asian Growth.

Host: Asian Dynasties & Deep Tech Founders

WHAT THIS PROGRAM ENTAILS

Program Details

Stewardship Sessions

These sessions will involve the stewards and experts. The agenda includes learning sessions, speaker-led sessions, and dedicated time for building deep and authentic relationships.

256 network Mentors

Stewards will be assigned a mentor based on their capstone focus area. Mentors will help shape perspectives, challenge their perspectives, and assist in unlocking macro and micro strategies.

Capstone Access

Stewards are required to build a capstone thesis in a particular area, working with the principles of family offices and present to a private 256 audience. Upon completion, stewards will formally enter the 256 Fellows Circle, ensuring continued access to this global trust network & vision.

One Global Summit

Join us at the 256 Global Summit, which provides access to the members of 256 Network, a global ecosystem of trust, discretion, and long-term alignment across sovereign wealth funds, pension funds, endowments, family offices, and private equity/venture capital firms.

The Fellowship Program

Tracks

Integrated Insight

These sessions will involve the stewards and experts. The agenda includes learning sessions, speaker-led sessions, and dedicated time for building deep and authentic relationships.

Invisible Leverage

Collaborate with leading founders and business decision-makers whose judgments move

capital, influence policy, and define new markets.

Inter-generational Capital

Moving beyond "quarterly returns" to 50-year horizons and multi-generational wealth preservation.

Institutional Continuity

These sessions will involve the stewards and experts. The agenda includes learning sessions, speaker-led sessions, and dedicated time for building deep and authentic relationships.

Selection Criteria

Selection Criteria

THe Journey

A one-year journey from insight to influence designed to shape tomorrow’s

capital leaders

1-2 Months: Alignment & The Boardroom

Stewards will engage in Boardroom Dialogues—intimate, closed-door deep dives into governance, family dynamics, and capital cycles with global leaders.

3-6 Months: The Capstone Construction

Partner with both 0-1 disruptors and scaled-up operators to master the craft of building. Navigate the chaos of early-stage execution and the systems of high-growth scaling—gaining the hands-on grit required to build new ventures from scratch.

7-8 Months: Validation & Execution

Stress-test stewards strategy against the wisdom of experienced allocators. Validate thesis, governance structure, or platform before real-world deployment.

9-12 Months: Integration

Present your Capstone to a private 256 Network audience. Upon completion, you formally enter the 256 Fellows Circle, ensuring continued access to this global trust network continues as they execute their vision.

THe Global Rotation

A one-year journey from insight to influence designed to shape tomorrow’s

capital leaders

Month 5: GCC (Sovereignty)

Focus: Geopolitics, Energy Transition, and Post-Oil Diversification.

Host: Sovereign Wealth Advisors & Mega-Project Developers.

Month 7: Asia (The Future)

Focus: Succession, Tech Innovation, and Asian Growth.

Host: Asian Dynasties & Deep Tech Founders

Month 1: Europe / UK (Governance)

Focus: The Constitution, Trust Structures, and Family Unity.

Host: Historic Multi-Family Offices.

Month 3: USA (Capital)

Focus: Deal Flow, Venture, and Allocation.

Host: Wall Street Allocators & VC Funds.

THe Global Rotation

A one-year journey from insight to influence designed to shape tomorrow’s

capital leaders

Month 5: GCC (Sovereignty)

Focus: Geopolitics, Energy Transition, and Post-Oil Diversification.

Host: Sovereign Wealth Advisors & Mega-Project Developers.

Month 7: Asia (The Future)

Focus: Succession, Tech Innovation, and Asian Growth.

Host: Asian Dynasties & Deep Tech Founders

Month 1: Europe / UK (Governance)

Focus: The Constitution, Trust Structures, and Family Unity.

Host: Historic Multi-Family Offices.

Month 3: USA (Capital)

Focus: Deal Flow, Venture, and Allocation.

Host: Wall Street Allocators & VC Funds.

Structure

Structure

Application

Application

Mastering global capital

from allocation to execution

Mastering global capital

from allocation to execution

Join the next cohort of the 256 Fellows making a global impact.

© 2025 256 Network. All rights reserved.

Crusoe

crusoe.ai

Program

A Private Fellowship for Future Leaders in Capital and Influence

A program dedicated to identifying, nurturing, and connecting extraordinary individuals who will spearhead innovation and foster positive change across various global sectors.